|

Pre-Tax Deduction List. Are Pre-Tax Deductions Good?. Do Pre-Tax Deductions Reduce Taxable Income?. Pre-Tax Deduction Example. . A pre-tax deduction is any money taken from an employee’s gross pay before taxes are withheld from the paycheck. These deductions reduce the employee’s taxable income, meaning they will owe less income tax. They may also owe less FICA tax, including Social Security and Medicare. Pre-tax deductions might lower employer-paid taxes like the Federal Unemployment Tax (FUTA), Show

Top 1: What are pre-tax deductions? | BambooHR GlossaryAuthor: bamboohr.com - 103 Rating

Description: Pre-Tax Deduction List. Are Pre-Tax Deductions Good?. Do Pre-Tax Deductions Reduce Taxable Income?. Pre-Tax Deduction Example A pre-tax deduction is any money taken from an employee’s gross pay before taxes are withheld from the paycheck. These deductions reduce the employee’s taxable income, meaning they will owe less income tax. They may also owe less FICA tax, including Social Security and Medicare. Pre-tax deductions might lower employer-paid taxes like the Federal Unemployment Tax (FUTA),

Matching search results: A pre-tax deduction is any money taken from an employee's gross pay before taxes are withheld from the paycheck. These deductions reduce the employee's ...A pre-tax deduction is any money taken from an employee's gross pay before taxes are withheld from the paycheck. These deductions reduce the employee's ... ...

Top 2: What Is a Pre-Tax Deduction? A Simple Guide to ... - FreshBooksAuthor: freshbooks.com - 116 Rating

Description: What Does Pre-Tax Deduction Mean?. What’s the Difference Between Pre-Tax. and After-Tax Deductions?. Can You Claim Pre-Tax Deductions?. Want to Learn More About Payroll? 4 Min. Read HubTaxesWhat Is a Pre-Tax Deduction? A Simple Guide to Payroll Deductions for Small BusinessMay 19, 2022Pre-tax deductions are payments toward benefits that are paid directly from an employee’s paycheck before withholding money for taxes. There are two types of benefits deductions: pre-tax deductions and post-tax de

Matching search results: A pre-tax deduction means that an employer is withdrawing money directly from an employee's paycheck to cover the cost of benefits, before withdrawing money to ...A pre-tax deduction means that an employer is withdrawing money directly from an employee's paycheck to cover the cost of benefits, before withdrawing money to ... ...

Top 3: What Are Pre-tax Deductions? Definition, Benefits & Types - PaycorAuthor: paycor.com - 165 Rating

Description: Help Employees Understand the Benefits of Pre-Tax Payroll Deductions. What are the different types of payroll deductions?. What are Examples of Pre-Tax Deductions?. How do pre-tax deductions impact taxes?. Rules and limits change annually Workforce ManagementHelp Employees Understand the Benefits of Pre-Tax Payroll DeductionsLast Updated: November 30, 2021 | Read Time: 8 minWhen it comes to your employees’ paycheck, it’s important to be well-versed on all forms of payroll deductions so you can

Matching search results: 30 Nov 2021 · Pre-tax deductions are deductions applied to an individual's gross income, thereby decreasing the amount of wages upon which local, state and ...30 Nov 2021 · Pre-tax deductions are deductions applied to an individual's gross income, thereby decreasing the amount of wages upon which local, state and ... ...

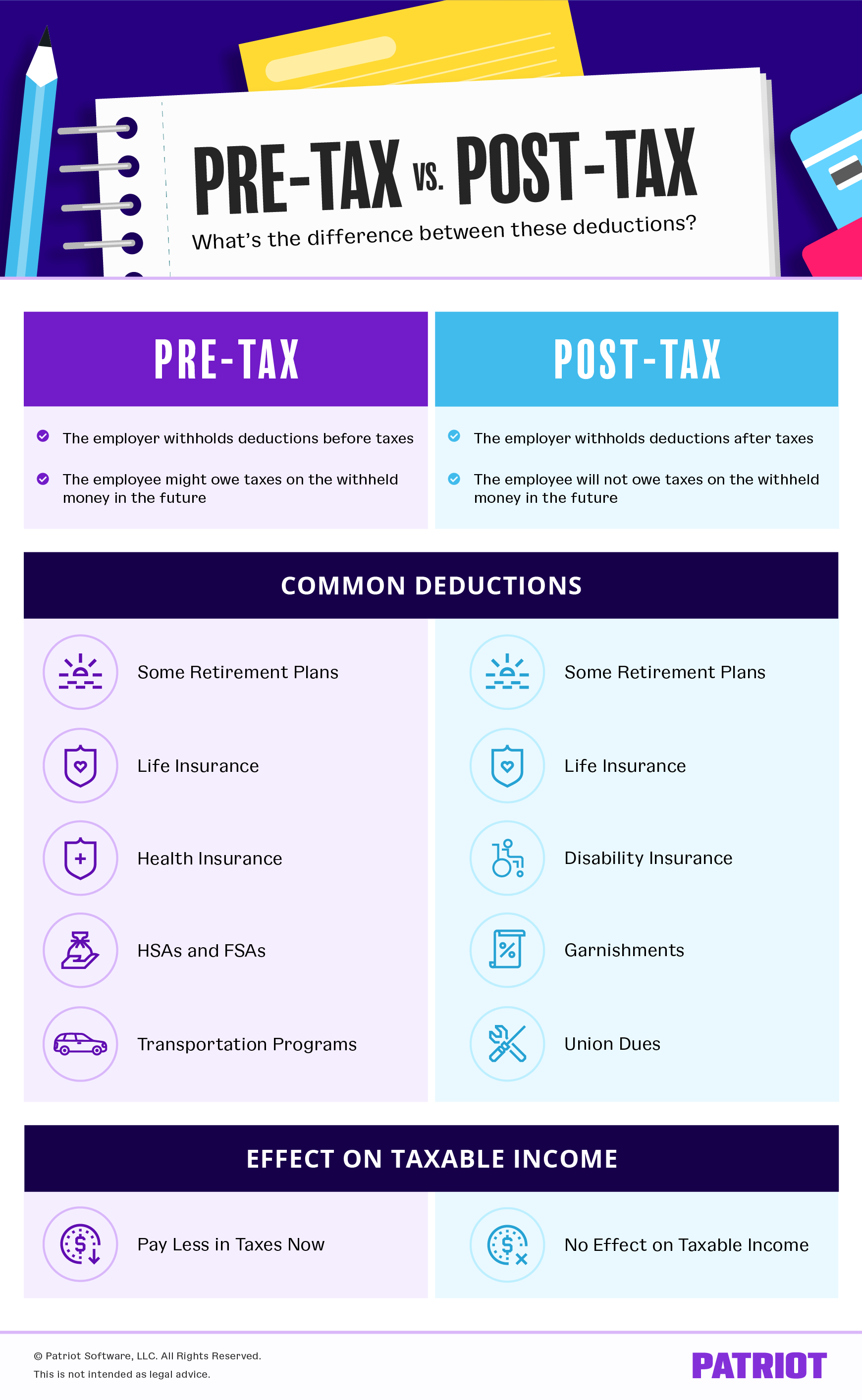

Top 4: Pre-tax vs. Post-tax Deductions - What's the Difference?Author: patriotsoftware.com - 132 Rating

Description: Common pre-tax deductions. Common post-tax deductions If you provide benefits to employees, you probably wonder how to withhold wages for the benefits properly. Do you withhold the premiums and contributions before or after taxes? Can you choose to withhold however you want? Well, it depends on the benefit. So, you must understand the difference between pre-tax vs. post-tax deductions. You will withhold pre-tax. deductions from employee wages before you withhold taxes. Pre-tax deductions reduce

Matching search results: 31 Aug 2022 · Remove pre-tax benefit deductions from employee pay before you deduct payroll taxes. Pre-tax deductions offer the benefit of lower tax ...31 Aug 2022 · Remove pre-tax benefit deductions from employee pay before you deduct payroll taxes. Pre-tax deductions offer the benefit of lower tax ... ...

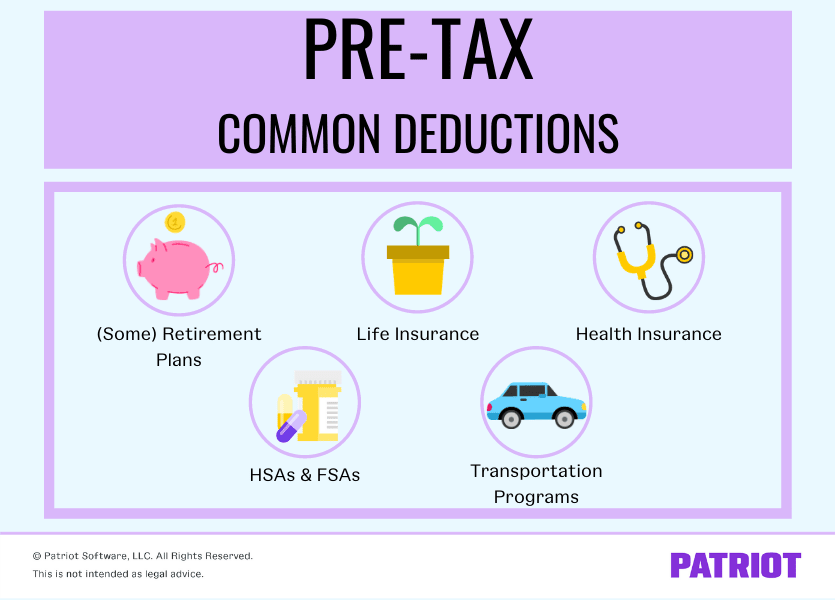

Top 5: What Are Pre-tax Deductions? | Definition, List, & ExampleAuthor: patriotsoftware.com - 142 Rating

Description: How do pre-tax deductions impact taxes?. Pre-tax. deductions list . Retirement plan contributions. Health insurance premiums. HSA and FSA contributions. Life insurance premiums. Transportation program contributions Do you need to withhold money from employee wages beyond taxes (e.g., garnishments or benefits)? Then you might be wondering when exactly you deduct the employee’s contributions—before or after taxes. Well, it depends. For accurate withholding, understand what are pre-tax deductions.

Matching search results: 1 Feb 2021 · A pre-tax deduction is money you remove from an employee's wages before you withhold money for taxes, lowering their taxable income.1 Feb 2021 · A pre-tax deduction is money you remove from an employee's wages before you withhold money for taxes, lowering their taxable income. ...

Top 6: What Are Pre-Tax Deductions? - ShortlisterAuthor: myshortlister.com - 99 Rating

Description: What Are Pre-Tax Deductions? . What Are Pre-Tax Deductions & Contributions? . What Qualifies for Pre-Tax Deductions? . Pre-Tax Deduction List . How Do Pre-Tax Deductions Affect Take-Home Pay? . Do Pre-Tax Deductions Reduce. Taxable Income? . Pre-Tax Deduction Example . Become a Shortlister Insider! . Get the latest news and insights on HR technology, employee benefits, and upcoming trends in the wellness world!. Written by Shortlister Editorial Team From pre-tax deductions and benefits to mandat

Matching search results: In other words, pre-tax payroll deductions are withdrawals from a person's gross pay for different types of benefits and contributions. The best thing is they ...In other words, pre-tax payroll deductions are withdrawals from a person's gross pay for different types of benefits and contributions. The best thing is they ... ...

Top 7: A 2022 Guide to Payroll Pretax Deductions - The Motley FoolAuthor: fool.com - 142 Rating

Description: Overview: What are pretax deductions?. Pretax deductions vs. post-tax deductions: What's the difference?. Types of pretax deductions. An example of a pretax deduction. You’re a third of the way there. Expert-picked business credit cards with rich rewards and perks. 1. Health plan contributions. 2. 401(k) contributions. 3. Commuting programs. 4. Group-term life. insurance contributions. 1. Identify potential pretax. deductions. 2. Identify applicable payroll taxes. 3. Calculate the employee’s gross wages. 4. Calculate the taxable wage base for each payroll tax.

Matching search results: 18 May 2022 · A pretax deduction is money taken out of an employee's paycheck before tax withholding. Pretax deductions behoove employees and employers ...18 May 2022 · A pretax deduction is money taken out of an employee's paycheck before tax withholding. Pretax deductions behoove employees and employers ... ...

Top 8: Pre-Tax and Post-Tax Deductions: What's the Difference?Author: apspayroll.com - 122 Rating

Description: The Difference Between Pre-Tax and Post-Tax Deductions . What are Pre-Tax. Deductions? . Types of Pre-Tax Deductions . Pre-Tax Deduction Example . What are Post-Tax Deductions? . Types of Post-Tax Deductions . Want to Know More About Garnishments? . Post-Tax Deduction Example . Want to Automate Your Payroll Taxes? . Which is Better, Pre-Tax or After Tax? . Voluntary and Involuntary Deductions . How APS Can Help With Pre-Tax and Post-Tax Deductions . Health Plan Contributions . Retirement Contributions . Disability Insurance . Employee Commuting Programs . Retirement Contributions . Step 1. Federal Income Taxes . Step 2. Social Security Taxes . Step 3. Medicare Taxes . Step 4. Post-Retirement Tax Contribution . A Note About Disability Insurance. A Note About Employee Commuting Programs. A Note About Life Insurance.

Matching search results: 17 Aug 2021 · A pre-tax deduction is a monetary amount withheld from employees' paychecks before any tax withholdings. These types of deductions benefit both ...17 Aug 2021 · A pre-tax deduction is a monetary amount withheld from employees' paychecks before any tax withholdings. These types of deductions benefit both ... ...

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 ihoctot Inc.