|

The Compound Interest Formula. How to Derive A = Pert the Continuous Compound Interest Formula. Excel: Calculate Compound Interest in Spreadsheets. Compound Interest Formulas Used in This Calculator. How to Use the Compound Interest Calculator: Example. Calculate Accrued Amount (Future Value FV) using A = P(1 + r/n)^nt. Calculate Rate using Rate Percent = n[ ( (A/P)^(1/nt) ) - 1] * 100. . Calculator UseThe compound interest calculator lets you see how your money can grow using interest compounding Show

Top 1: Compound Interest CalculatorAuthor: calculatorsoup.com - 113 Rating

Description: The Compound Interest Formula. How to Derive A = Pert the Continuous Compound Interest Formula. Excel: Calculate Compound Interest in Spreadsheets. Compound Interest Formulas Used in This Calculator. How to Use the Compound Interest Calculator: Example. Calculate Accrued Amount (Future Value FV) using A = P(1 + r/n)^nt. Calculate Rate using Rate Percent = n[ ( (A/P)^(1/nt) ) - 1] * 100 Calculator UseThe compound interest calculator lets you see how your money can grow using interest compounding

Matching search results: The compound interest calculator lets you see how your money can grow using interest compounding. Calculate compound interest on an investment, 401K or savings account with annual, quarterly, daily or continuous compounding. We provide answers to your compound interest calculations and show you the steps to find the answer. ...

Top 2: Calculate Compound Interest: Formula with examples and …Author: mathwarehouse.com - 127 Rating

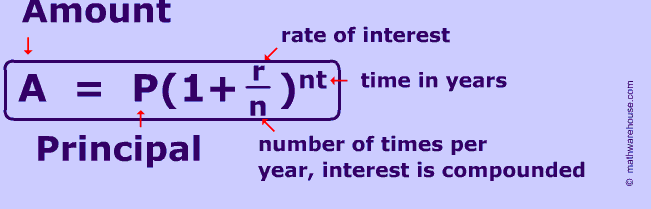

Description: Compound interest is a great thing when you are earning it! Compound interest is when a bank pays interest on both the principal (the original amount of money)and the interest an account has already earned. To calculate compound interest use the. formula below. In the formula, A represents the final amount in the account after t years compounded 'n' times at. interest rate 'r' with starting amount 'p' . This page focuses on understanding the formula for compound interest ; if you're intere

Matching search results: Compound interest is a great thing when you are earning it! Compound interest is when a bank pays interest on both the principal (the original amount of money)and the interest an account has already earned.. To calculate compound interest use the formula below. In the formula, A represents the final amount in the account after t years compounded 'n' times at interest rate … ...

Top 3: The Power of Compound Interest: Calculations and Examples - InvestopediaAuthor: investopedia.com - 129 Rating

Description: What Is Compound Interest? . How Compound Interest Works . The Power of Compound Interest . Compound Interest Schedules . Compound Interest: Start Saving Early . Pros and Cons of Compounding . Compound Interest Investments . Tools for Calculating Compound Interest . How Can I Tell if Interest Is Compounded?. What Is a Simple Definition of Compound Interest?. Who Benefits From Compound Interest?. Can Compound Interest Make You Rich?. Compounding Periods . Calculating Compound Interest in Excel . Other Compound Interest Calculators . Understanding Compound Interest.

Matching search results: Jul 19, 2022 · Compound interest (or compounding interest) is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan . Thought to have ... ...

Top 4: Compound Interest Calculator [with Formula]Author: omnicalculator.com - 99 Rating

Description: Interest. rate definition. What is the compound interest definition?. Simple vs. compound interest. Compounding frequency. Compound interest formula. How to calculate compound interest. Compound interest examples. Example 1 – basic calculation of the value of an investment. Example 2 - complex calculation of the value of an investment. Example 3 - Calculating the interest rate of an investment using the compound interest formula. Example 4 - Calculating the doubling time of an investment using the compound interest formula. Compound interest table. Additional Information.

Matching search results: Aug 08, 2022 · The compound interest formula is an equation that lets you estimate how much you will earn with your savings account. It's quite complex because it takes into consideration not only the annual interest rate and the number of years but also the number of times the interest is compounded per year. The formula for annual compound interest is as ... ...

Top 5: How Compound Interest on a Savings Account Works | Credit KarmaAuthor: creditkarma.com - 134 Rating

Description: One of the best parts of opening a savings account is watching the money you deposit grow over time, thanks to. interest.. How often does a savings account. compound interest?. How do you calculate compound interest?. Factors that affect how much interest you earn. The amount of money in your account Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our third-party advertisers don’t review, approve or endorse our editor

Matching search results: Mar 14, 2022 · A compound interest savings account can help you grow your money over time, whether you’re working with a large or small balance. Compounding means you earn interest on both your principal — the amount you’ve saved — and the interest you’ve already accrued. How fast your money grows is determined by your interest rate, balance and how ... ...

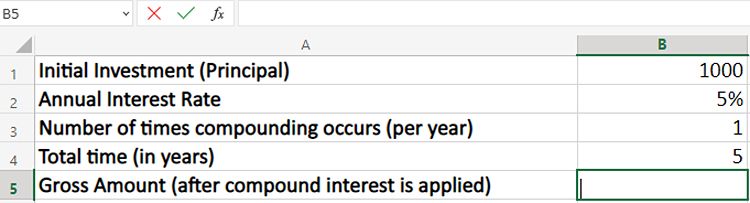

Top 6: How to Create a Compound Interest Calculator in ExcelAuthor: makeuseof.com - 117 Rating

Description: How Does Compound Interest Work?. Calculate Compound Interest Using the Formula in Excel. Calculate Compound Interest Using the FV Function. Calculate Compound Interest for an Intra-Year Period. Learning to Find Compound Interest. With Ease. Calculate Intra-Year Compound Interest Using the Formula. Calculating Intra-Year Compound Interest Using the EFFECT. Function Compound interest is one of the most powerful financial concepts with applications in banking, accounting, and finance. If you'r

Matching search results: Nov 02, 2022 · Calculate Compound Interest Using the Formula in Excel. Now that we've understood how compound interest works let's learn how to calculate compound interest in Excel using the compound interest formula. The compound interest formula is: P ’ =P(1+R/N)^NT. Here: P is the principal or the initial investment. ...

Top 7: Compound Interest Calculator - MoneychimpAuthor: moneychimp.com - 110 Rating

Description: Compound Interest Formula . Inputs. Current Principal:. $ Annual Addition:. $ Years to grow:. Interest Rate:. . %. Compound interest time(s) annually. Make additions at start end of each compounding period. . Results. Future Value:. $ Compound Interest Formula Compound interest - meaning that the interest you earn each year is added to your principal, so that the balance doesn't merely grow, it grows at an increasing rate - is one of the most useful concepts in finance. I

Matching search results: Compound Interest Formula. Compound interest - meaning that the interest you earn each year is added to your principal, so that the balance doesn't merely grow, it grows at an increasing rate - is one of the most useful concepts in finance. It is the basis of everything from a personal savings plan to the long term growth of the stock market. ...

Top 8: Compound Interest Calculator – Forbes AdvisorAuthor: forbes.com - 115 Rating

Description: What Is Compound Interest?. How to Use the Compound Interest Calculator. How Does. Compound Interest Work?. Where Is Compound Interest Used?. Frequently Asked Questions (FAQs) . Is compound interest exponential?. Do checking accounts earn compound. interest?. What types of accounts earn compound interest? Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evaluations. What Is Compound Interest?Compound interest is a form

Matching search results: Jul 22, 2022 · Compound interest is a form of interest calculated using the principal amount of a deposit or loan plus previously accrued interest. ... A savings account’s compound interest rate is typically ... ...

Top 9: Compound Interest Calculator | Wealth MetaAuthor: wealthmeta.com - 108 Rating

Description: This calculator shows how your money grows using compounding interest and displays a graph of the results. Supports regular contributions or withdraws which may be useful for estimating retirement outcomes. Includes inflation adjustment to see the real vs nominal return. What makes compounding special is, the amount gained increases each time it compounds. The basis for making compounding work is that the gains are reinvested.Imagine. starting an account with $100 that grows at 5% annually. At t

Matching search results: Interest rate - the rate the money grows at. An average annual return in a conservative portfolio with 50% bonds and 50% stocks might be 5%. Term - how many years to compound. Compound Frequency - how often does the balance compound (yearly, quarterly, monthly, twice monthly). The more frequent the contributions, the more it grows. ...

Top 10: What Is Compound Interest? | BankrateAuthor: bankrate.com - 96 Rating

Description: Compound interest definition. How does compound interest work?. How to take advantage of compound interest. 3. Check the frequency of compounding Compound interest is a powerful force for consumers looking to build their savings. Knowing how it works and how often your bank compounds interest can help you make smarter decisions about where to put your money.Compound interest definitionIn simple terms, compound interest is interest you earn on interest. With a savings account that earns compound

Matching search results: Mar 9, 2022 · In simple terms, compound interest is interest you earn on interest. With a savings account that earns compound interest, you earn interest ...Daily compounding: $105,126.75Annual compounding: $105,000Mar 9, 2022 · In simple terms, compound interest is interest you earn on interest. With a savings account that earns compound interest, you earn interest ...Daily compounding: $105,126.75Annual compounding: $105,000 ...

Top 11: How Compound Interest on a Savings Account Works | Credit KarmaAuthor: creditkarma.com - 134 Rating

Description: One of the best parts of opening a savings account is watching the money you deposit grow over time, thanks to. interest.. How often does a savings account. compound interest?. How do you calculate compound interest?. Factors that affect how much interest you earn. The amount of money in your account Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesn’t affect our editors’ opinions. Our third-party advertisers don’t review, approve or endorse our editor

Matching search results: Mar 14, 2022 · Savings accounts typically grow with compound interest — that means you earn interest both on the amount you've saved and any interest you ...What is compound interest on... · How do you calculate...Mar 14, 2022 · Savings accounts typically grow with compound interest — that means you earn interest both on the amount you've saved and any interest you ...What is compound interest on... · How do you calculate... ...

Top 12: The Life-Changing Magic Of Compound Interest - ForbesAuthor: forbes.com - 112 Rating

Description: What Is Compound Interest?. Simple Interest vs. Compound Interest. Looking For A Financial Advisor?. Understanding Compound Interest. Compound Interest Formula. Simple Interest Formula. Examples of Compound Interest. Making Compound Interest Work for You. Compound Interest Formula Excel Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evaluations. Compound interest is when the interest you earn on a balance in a savin

Matching search results: Jul 14, 2022 · Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested, earning you more interest.Jul 14, 2022 · Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested, earning you more interest. ...

Top 13: What is Compound Growth - Investing Basics - Wells FargoAuthor: wellsfargo.com - 138 Rating

Description: Empower yourself with financial knowledge. Make compound growth work for you Compounding is a powerful investing concept that involves earning returns on both your original investment and on returns you received previously. For compounding to work, you need to reinvest your returns back into your account. For example, you invest $1,000 and earn a 6% rate of return. In the first year, you. would make $60, bringing your total investment to $1,060, if you reinvest your return.Next year, you would e

Matching search results: Compounding is a powerful investing concept that involves earning returns on both your original investment and on returns you received previously.Compounding is a powerful investing concept that involves earning returns on both your original investment and on returns you received previously. ...

Top 14: What is compound interest? - Fidelity InvestmentsAuthor: fidelity.com - 125 Rating

Description: How does compound interest work?. Compound interest and your finances. How can investors receive. compounding returns?. Next steps to consider Key takeawaysCompound interest helps your money work harder.Unlike simple interest, compound interest lets your returns earn returns of their own.Money invested in the stock market and in savings accounts may benefit from compound interest.Thanks to its potential to grow savings over time, the idea of compound. interest is what motivates many people to sta

Matching search results: Oct 14, 2022 · Compound interest is when interest you earn in a savings or investment account earns interest of its own. (So meta.) In other words, you earn ...Oct 14, 2022 · Compound interest is when interest you earn in a savings or investment account earns interest of its own. (So meta.) In other words, you earn ... ...

Top 15: What is Compound Interest? - NerdWalletAuthor: nerdwallet.com - 107 Rating

Description: Compound interest definition. How compound interest works. The difference between simple interest and compound interest. The compound interest formula Compound interest definitionCompound interest is the money your bank pays you on your balance — known as interest — plus the money your interest earns over time. It’s a way to make your cash work for you. How quickly your money grows is determined by your rate, bank balance and the number of times your bank pays interest, or “compounds.”LendingCl

Matching search results: Nov 23, 2020 · Compound interest is the money your bank pays you on your balance — known as interest — plus the money your interest earns over time. It's a way ...Nov 23, 2020 · Compound interest is the money your bank pays you on your balance — known as interest — plus the money your interest earns over time. It's a way ... ...

Top 16: The Power of Compound Interest: Calculations and ExamplesAuthor: investopedia.com - 114 Rating

Description: What Is Compound Interest? . How Compound Interest Works . The Power of Compound Interest . Compound Interest Schedules . Compound Interest: Start Saving Early . Pros and Cons of Compounding . Compound Interest Investments . Tools for Calculating Compound Interest . How Can I Tell if Interest Is Compounded?. What Is a Simple Definition of Compound Interest?. Who Benefits From Compound Interest?. Can Compound Interest Make You Rich?. Compounding Periods . Calculating Compound Interest in Excel . Other Compound Interest Calculators . Understanding Compound Interest.

Matching search results: The first way to calculate compound interest is to multiply each year's new balance by the interest rate. Suppose you deposit $1,000 into a savings account with ...The first way to calculate compound interest is to multiply each year's new balance by the interest rate. Suppose you deposit $1,000 into a savings account with ... ...

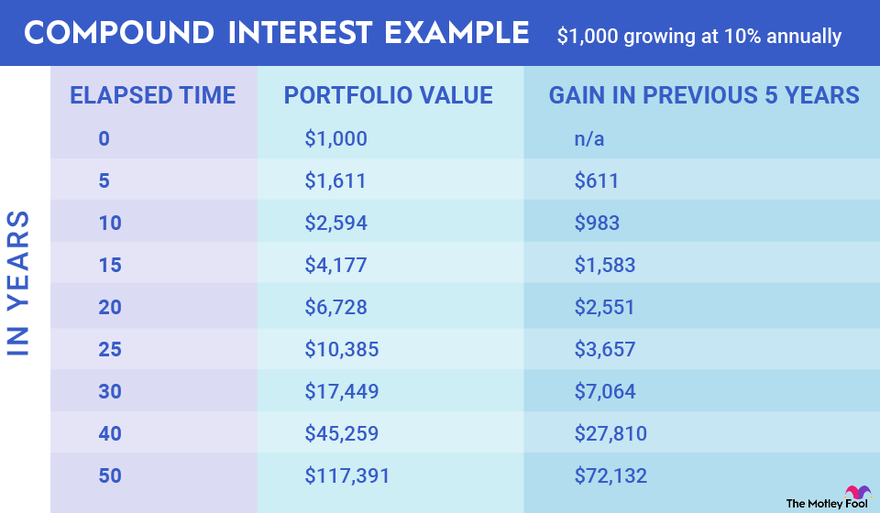

Top 17: Accounts That Earn Compounding Interest | The Motley FoolAuthor: fool.com - 136 Rating

Description: How compound interest works. Simple interest versus compound. interest. Compound interest formula. Which types of accounts offer compound interest?. Compound interest in current events. Who benefits from compound interest?. Related investing topics. Can compound interest make you rich? If your investment account earns compound interest, then you are earning interest on interest as well as on your investments. Compound interest is undoubtedly the most important concept to understand when building

Matching search results: If your investment account earns compound interest, then you are earning interest on interest as well as on your investments. Compound interest is ...If your investment account earns compound interest, then you are earning interest on interest as well as on your investments. Compound interest is ... ...

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 ihoctot Inc.