|

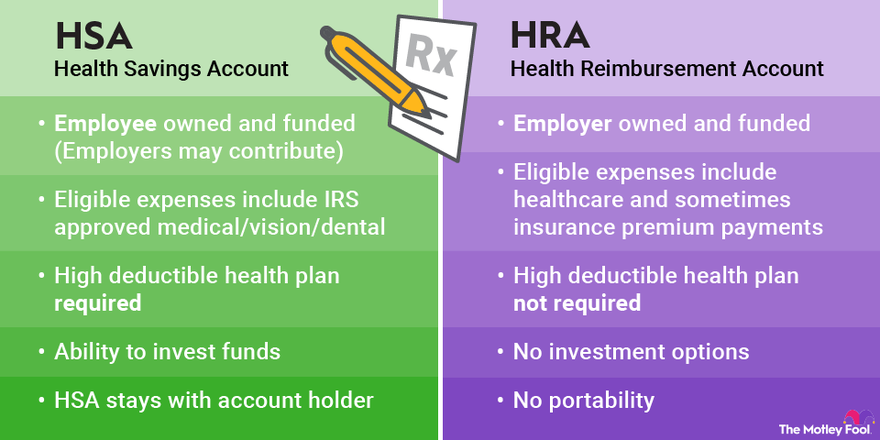

Key differences between HRAs and HSAs. HRA vs. HSA eligible expenses. HRA vs. HSA comparison chart. HRA advantages and disadvantages. Related Investing Topics. HSA advantages and. disadvantages. . Health reimbursement accounts (HRAs) and health savings accounts (HSAs) can reduce the costs of paying for medical care, but there are important differences between these two savings vehicles.The main difference between HRAs and HSAs is that you own your HSA, while your employer owns and funds your HRA an Show

Top 1: HRA vs. HSA Accounts: A Comparison - The Motley FoolAuthor: fool.com - 105 Rating

Description: Key differences between HRAs and HSAs. HRA vs. HSA eligible expenses. HRA vs. HSA comparison chart. HRA advantages and disadvantages. Related Investing Topics. HSA advantages and. disadvantages Health reimbursement accounts (HRAs) and health savings accounts (HSAs) can reduce the costs of paying for medical care, but there are important differences between these two savings vehicles.The main difference between HRAs and HSAs is that you own your HSA, while your employer owns and funds your HRA an

Matching search results: WebNov 21, 2022 · Key differences between HRAs and HSAs. 1. Ownership: A health reimbursement account or arrangement (HRA) is an account to which your employer contributes a set amount of money. The money is used ... ...

Top 2: How to Use Your HSA, HRA, or FSA | CignaAuthor: cigna.com - 108 Rating

Description: 1"Medical care" expenses as defined by IRS Code, Section 213(d) include amounts paid for the diagnosis, treatment, or prevention of disease, and for treatments affecting any part or function of the body. The expenses must be to alleviate or prevent a physical defect or illness. Expenses for solely cosmetic reasons generally are not expenses for medical care. Examples include face lifts, hair transplants, and hair removal. (electrolysis). Also, expenses that are merely beneficial to one's general

Matching search results: WebFSA, HRA, and HSA Frequently Asked Questions What FSA expenses, HRA expenses and HSA expenses can be reimbursed? You can use your HSA or Health Care FSA to reimburse yourself for medical and dental expenses that qualify as federal income tax deductions (whether or not they exceed the IRS minimum applied to these deductions) … ...

Top 3: Can You Have an HRA and HSA at the Same Time?Author: dpath.com - 92 Rating

Description: The Advantages of Having an HRA and HSA. Health Savings Account. Health Reimbursement Arrangement. Four HRA plan types that are compatible with an HSA: Healthcare spending accounts, such as Health Reimbursement Arrangements (HRAs) and Health. Savings Accounts (HSAs), help individuals and families pay for medical expenses. They also provide more control over how and where to pay for those expenses. One frequently asked question is “Can a person have both an HRA and HSA at the same time?”.The answ

Matching search results: WebOnce those conditions are met, there are four HRA plan types (which vary by employer) that are compatible with an HSA, per IRS regulations. Four HRA plan types that are compatible with an HSA: Limited Purpose HRA: Pays or reimburses only permitted coverage (including vision and dental), permitted insurance or preventative care. These expenses ... ...

Top 4: HSA, HRA, & FSA Eligible Items & Expenses | CignaAuthor: cigna.com - 122 Rating

Description: Alphabetical List of Covered and Not Covered Items You can pay for certain health care, vision, and dental costs with an HRA, HSA, or Health Care FSA. The type of account you have may determine whose costs are covered and which costs are eligible.HSA - You can use your HSA to pay for eligible health care, dental, and vision expenses for yourself, your spouse, or eligible dependents (children, siblings, parents, and others who are considered an. exemption under Section 152 of the tax code).HRA -

Matching search results: WebJan 01, 2020 · However, COBRA premiums are reimbursable under an HSA, and may be reimbursable under an HRA. Your employer determines which health care expenses are eligible under an HRA. To determine if a specific expense is paid by your HRA, please refer to your coverage plan. Coinsurance amounts - Medical coinsurance amounts and … ...

Top 5: HRA vs. HSA: What’s The Difference? – Forbes AdvisorAuthor: forbes.com - 115 Rating

Description: How Can You Use HSA Money?. How Can You Use HRA Money?. Find The Best Health Insurance Companies Of 2022. HSA and HRA Frequently Asked Questions . Average employer HSA and HRA contributions for single coverage. Can I take out money from an HRA for non-medical expenses? . How much money can I put into an HSA and HRA? . Can you take an HRA with you if you. change jobs? . Can you use HRA and HSA funds to pay for dental care? . Qualified small employer health reimbursement. arrangement (QSEHRA). Individual coverage health reimbursement arrangement. Excepted benefit HRA (EBHRA).

Matching search results: WebNov 02, 2022 · You don’t contribute to an HRA, unlike an HSA or FSA. ... Summary: HSA vs. HRA. HSA HRA; Annual amount you can contribute: $3,650 for self-only coverage $7,300 for family coverage: ...

Top 6: HRA vs HSA: Which Is Right for You? - RamseyAuthor: ramseysolutions.com - 96 Rating

Description: 6 Differences Between an HRA vs HSA. HRA vs HSA: Which Is Right for You?. 5. Contribution Limits . 8 Min Read | Dec 15, 2022 . Let’s face it: Navigating the ins and outs of health insurance options is not for the faint of heart. But one silver lining to this complicated ball of wax is that you have more control of how your health care dollars are spent than ever before.One of the ways you can start making your health care funds work for you is through a health reimbursement arrangement (HRA) or

Matching search results: WebDec 15, 2022 · If you don’t have an HDHP, you can’t have an HSA. 6 Differences Between an HRA vs HSA. Both HRAs and HSAs are designed to give you more control of the money you spend on your health care. And they’re both intended to be used for qualified medical expenses. But that’s about where the similarities end. ...

Top 7: Can I have an HSA and FSA account at the same time?Author: dpath.com - 102 Rating

Description: Which Should I Use First? If your employer offers both Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs), you may be wondering if it’s possible to have both an HSA and an FSA account at the same time.HSA/FSA AccountsIf you are enrolled in an. HSA-eligible health plan, you can enroll in an HSA account as long as you aren’t also enrolled in Medicare or have some other, disqualifying coverage.Traditional FSA accounts cover most of the same healthcare expenses as HSA accounts and

Matching search results: WebHowever, you cannot enroll in a traditional FSA account if you are already enrolled in an HSA and vice-versa. You can, though, participate in what is known as a Limited Purpose FSA (LPFSA) at the same time as an HSA. Limited FSA Accounts. Although FSAs and LPFSAs have the same annual contribution limit ($2,850 for 2022), LPFSAs can be used … ...

Top 8: HSA vs. HRA: What’s the Difference and Which One Should You …Author: smartasset.com - 115 Rating

Description: Who Should Get an HSA?. Who Should Get an HRA?. Can You Have an HSA and an HRA?. Pros of a Health Savings Account. Cons of a Health Savings Account. HRA Pros of a Health Reimbursement Account. HRA Cons of a Health Reimbursement. Account Tap on the profile icon to edityour financial details. As Americans pay more for healthcare, many seek new ways to save in case of emergencies. Some may not even know they have access to health savings accounts (HSAs) and health reimbursement accounts (HRAs),

Matching search results: WebSep 28, 2022 · Post-Deductible HRA: Covers qualified medical expenses after you pay off your deductible. Retirement HRA: These cover qualified medical expenses after retirement. However, you can use your HSA up until that point in time before you lose eligibility for an HSA. At this point, you can use your HRA. The Bottom Line ...

Top 9: Can I Use My HSA/FSA for Glasses & Contacts? (2022 Update) - Vision CenterAuthor: visioncenter.org - 133 Rating

Description: What Are HSA and FSA? HSA vs. FSA Comparison Table. HSA and FSA Coverage. What Isn’t Covered by HSA and FSA?. Where Can I Get Glasses and Contacts with My HSA/FSA?. Best Places to Buy Glasses with HSA/FSA. Best Place to Buy Contacts with HSA/FSA Both HSA and FSA cover prescription eyewear.If you don’t have vision insurance, these accounts help save you money on health care. What Are HSA and FSA?HSA and FSA are untaxed accounts that allow you to pay for medical expenses. There are. some key

Matching search results: WebDec 12, 2022 · HSA vs. FSA Comparison Table. Health Savings Account (HSA) Flexible Savings Account (FSA) Requirements: You must have a high-deductible health plan and can’t be eligible for Medicare: Must be offered by your employer: ... “HSA, HRA, Healthcare FSA and Dependent Care Eligibility List.” ...

Top 10: Participants - American Benefits Group - amben.comAuthor: amben.com - 89 Rating

Description: Get Your Benefits On the Go!. Personal Attention and Great Service Benefits BlogABG Smart Mobile. Get Your Benefits On the Go!Account Balances & Transaction HistoryClaims Submission Including Receipt UploadLearn moreStaff Photography by Jessica Marie Photography. Inc. Latest ReviewsPersonal Attention and Great Service Name of Review: Alex AI was very impressed with American Benefits Group after separation from my employer. When I would call, I would. reach an individual very quickly and they

Matching search results: WebAmerican Benefits Group can help participants understand their FSA accounts by offering the support and online tools needed to make the most of your benefits. ... Education Campaigns for HSA and Health FSA. Open Enrollment; Ongoing Monthly Engagement; Employee Care Card. ... (FSA) Health Reimbursement Arrangements (HRA) Health … ...

Top 11: HSA vs. FSA vs. HRA - Healthcare Account Comparison - HealthEquityAuthor: healthequity.com - 109 Rating

Description: HSA vs. FSA vs. HRAHealthcare Account comparison. Which one will benefit me the. most?. Side-by-side comparison HSA vs. FSA vs. HRAHealthcare Account comparisonHealth Savings Accounts (HSAs), Healthcare Flexible Spending Accounts (FSAs), and Health Reimbursement Arrangements (HRAs) each let members use tax-advantaged dollars to pay for qualified medical expenses. But there are some important differences to keep in mind.Which one will benefit me the. most?Consider an HSA if you want to…Save a bunc

Matching search results: Health Savings Accounts (HSAs), Healthcare Flexible Spending Accounts (FSAs), and Health Reimbursement Arrangements (HRAs) each let members use tax-free dollars ...Health Savings Accounts (HSAs), Healthcare Flexible Spending Accounts (FSAs), and Health Reimbursement Arrangements (HRAs) each let members use tax-free dollars ... ...

Top 12: HSAs, HRAs, and FSAs - CignaAuthor: cigna.com - 78 Rating

Description: View Cigna Company Names1 Plans vary, but this is how an HSA generally works. You cannot open an HSA if, in addition to coverage under an HSA-qualified High Deductible Health Plan ("HDHP"), you are also covered under a Health Flexible Spending Account (FSA) or an HRA or any other health coverage that is not a HDHP. Prior to enrollment with. an HSA provider, you must certify that you have enrolled or plan to enroll under a HDHP and are not covered under any other health coverage that is not a HDHP

Matching search results: HSAs, HRAs, and FSAs are types of accounts you can use to pay for certain health care expenses for you and your covered dependents.HSAs, HRAs, and FSAs are types of accounts you can use to pay for certain health care expenses for you and your covered dependents. ...

Top 13: What Is the Difference Between an FSA, HRA and HSA?Author: businessnewsdaily.com - 113 Rating

Description: The difference between FSAs, HRAs and HSAs. Flexible spending account (FSA). Health reimbursement account (HRA). Health savings account (HSA). FSA vs. HRA vs. HSA FAQs. Can you claim FSAs on your taxes?. Do you need an FSA if you have an HRA?. Do you get a debit card with an HRA?. How much should you put in an HSA?. How do you choose the right supplemental healthcare account for your company? FSAs, HRAs and HSAs all offer tax-free savings employees can use to pay for eligible medical, dental an

Matching search results: The primary differences between FSAs, HRAs, and HSAs are based on their ownership, funding, and requirements. Although each account type generally includes tax- ...The primary differences between FSAs, HRAs, and HSAs are based on their ownership, funding, and requirements. Although each account type generally includes tax- ... ...

Top 14: HRA vs. HSA vs. FSA comparison chart - PeopleKeepAuthor: peoplekeep.com - 115 Rating

Description: Why should I offer an account-based health plan (ABHP)?. What account-based health plan options are available?. Alternatives to account-based plans. Health reimbursement arrangement (HRA). Health. savings account (HSA). Flexible. spending account (FSA) Originally published on June 30, 2022. Last updated December 8, 2022. As healthcare costs continue to rise, small and midsize employers are searching for a way to offer their employees a competitive. health benefit to compete with larger organizat

Matching search results: Jun 30, 2022 · Plans like health reimbursement arrangements (HRAs), health savings accounts (HSAs), and flexible spending accounts (FSAs) all help employers ...Jun 30, 2022 · Plans like health reimbursement arrangements (HRAs), health savings accounts (HSAs), and flexible spending accounts (FSAs) all help employers ... ...

Top 15: HSA, FSA, HRA: What's the difference? - DataPath, Inc.Author: dpath.com - 99 Rating

Description: What are HSAs, FSAs and HRAs?. How are HSAs, FSAs and HRAs similar?. What is the difference between HSA and FSA and HRA?. Health Savings Accounts (HSAs). Flexible Spending Accounts (FSAs). Health Reimbursement Arrangements (HRAs). HSA vs. FSA vs. HRA – Breaking Down the. Differences Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), and Health Reimbursement Arrangements (HRAs) have similar acronyms, and the confusion doesn’t end there. While they all offer valuable benefits, some

Matching search results: Health Reimbursement Arrangements (HRAs) are employer-owned and funded accounts that can be used to pay for qualified out-of-pocket medical expenses for ...Health Reimbursement Arrangements (HRAs) are employer-owned and funded accounts that can be used to pay for qualified out-of-pocket medical expenses for ... ...

Top 16: FSA vs. HRA vs. HSA: The DifferencesAuthor: datapathadmin.com - 80 Rating

Description: FSA vs. HRA vs. HSA: The Overview. FSA vs. HRA vs. HSA: The Infographic. Flexible. Spending Account (FSA). Health Reimbursement Arrangement (HRA). Health Savings Account (HSA) When it comes to FSA vs. HRA vs. HSA, can you tell the differences? Each has a distinct purpose. Below is a quick overview and helpful infographic that compares specific features of each type of account.Three consumer-directed healthcare (CDH) benefit accounts offer tax advantages.. They include Flexible Spending Accounts (

Matching search results: While these accounts bear some similarities, they are not the same. Employers sponsor all of them, and they all offer tax advantages, help offset the cost of ...While these accounts bear some similarities, they are not the same. Employers sponsor all of them, and they all offer tax advantages, help offset the cost of ... ...

Top 17: HSAs vs HRAs vs FSAs Account Comparison | Optum FinancialAuthor: connectyourcare.com - 114 Rating

Description: Health Savings Account (HSA). Health Reimbursement Arrangement (HRA). Flexible Spending Account (FSA). Learn About Tax-Advantaged Employee Benefits. HSA and FSA. Eligible Expenses for Mom, Baby, and Parents-to-be. Estimate Growth Potential. Our Latest Blog Posts HSA vs. HRA vs. FSA ComparisonConnectYourCare2022-10-27T10:46:51-04:00Health savings accounts (HSAs), health reimbursement arrangements (HRAs), and flexible spending accounts (FSAs) can all help you pay for qualified expenses related to

Matching search results: Health savings accounts (HSAs), health reimbursement arrangements (HRAs), and flexible spending accounts (FSAs) can all help you pay for qualified expenses ...Health savings accounts (HSAs), health reimbursement arrangements (HRAs), and flexible spending accounts (FSAs) can all help you pay for qualified expenses ... ...

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 ihoctot Inc.